taxing unrealized gains explained

Is a Wealth Tax on Unrealized Capital Gains the Final Straw. Somehow in the next year the company sells the securities at.

Unrealized Capital Gains Tax Explained

Example of New Proposed Wealth Tax on Unrealized Capital Gains Explained.

. So an unrealized gain or loss is when the value of an asset has increased or decreased but you havent actually sold it yet. Bidens Proposal to Tax Unrealized Gains Upon Death of Asset Owner. A tax on unrealized capital gains would be a direct tax because its a tax on personal property paid by someone who cannotquoting the Pollock decisionshift the.

The profit booked will be only paper profit and the company is not liable to pay any taxes for recording unrealized gains. There is now legislative language behind the push to tax American billionaires on unrealized capital gains as Sen. Currently the tax code stipulates that unrealized capital gains are not taxable income.

An unrealized gain refers to the potential profit you could make from selling your investment. The third problem is the exemption for unrealized gains on assets that taxpayers leave to their. Ron Wyden last night released his 107-page plan.

Gains and losses are realized at the point of sale. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. The Problems With an Unrealized Capital Gains Tax.

We estimate that taxing unrealized capital gains at death with a 1 million exemption and increasing the tax rate on capital gains and qualified dividends would raise. This tax on unrealized gains would create a new tax system that requires taxpayers to pay tax on the value of an asset based on the value of these assets on a particular. In other words if an asset is projected to make money but you dont cash in on that.

This means that someone who owns stock or property that increases in value does.

America S Richest Would Finally Pay Taxes On Most Of Their Income Under Wyden S Billionaires Income Tax Itep

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Maximizing Nua Benefits For Employee Stock Ownership Plans

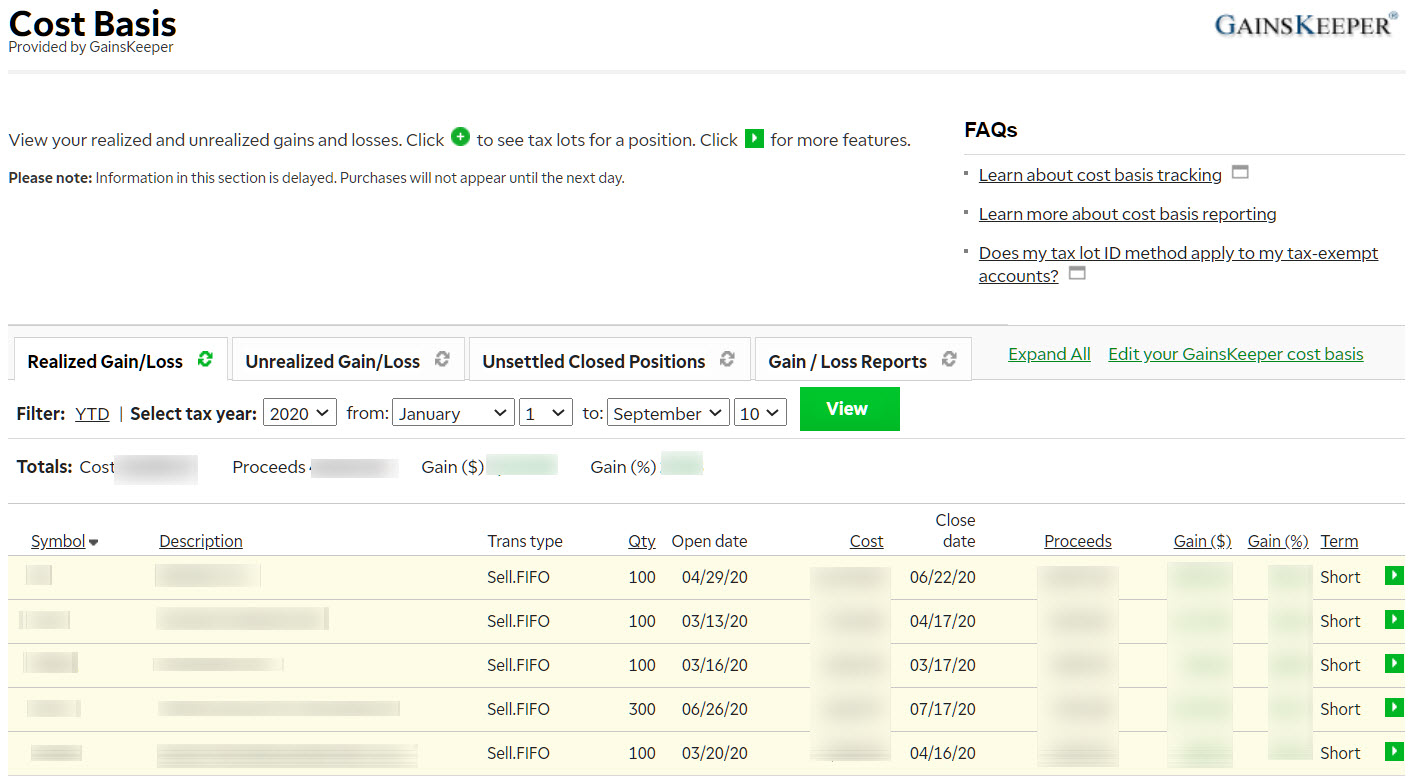

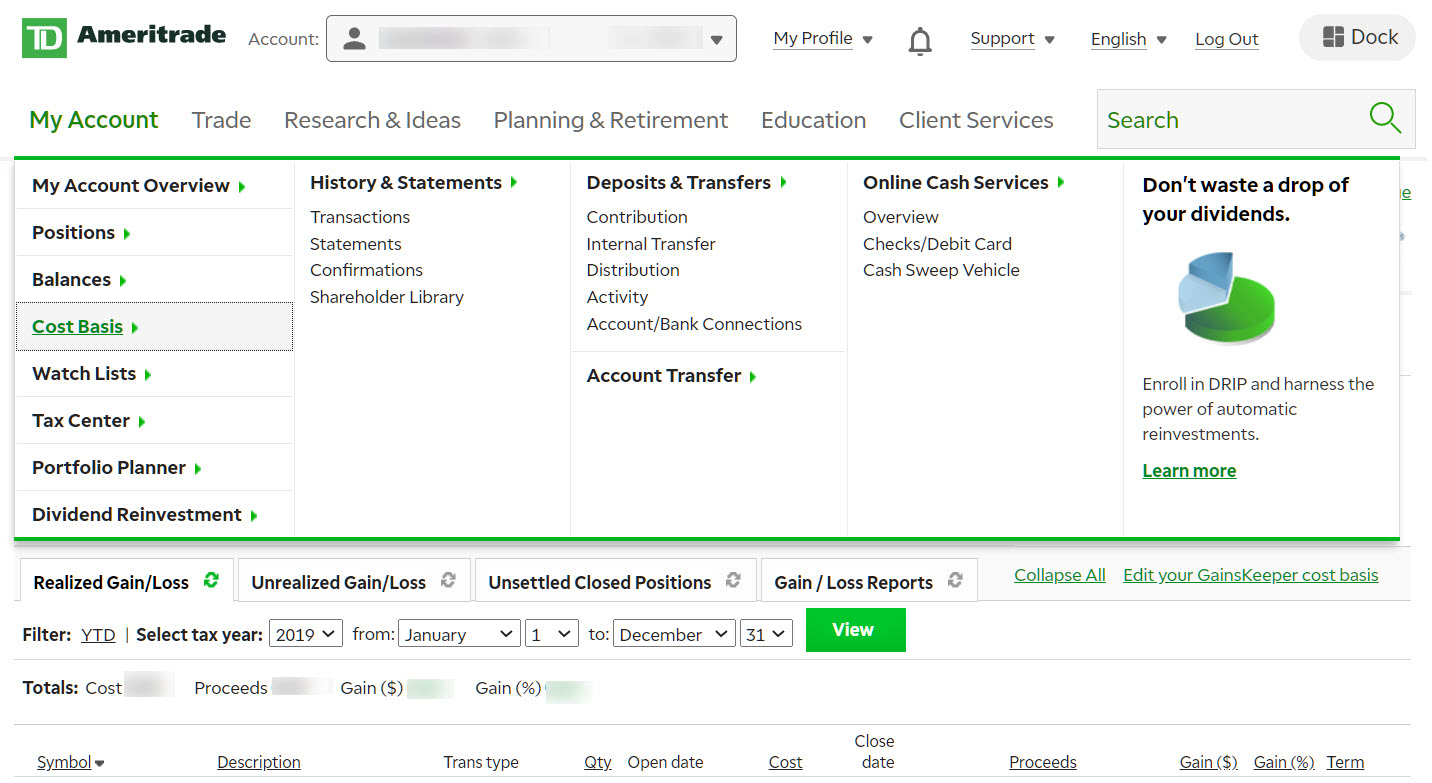

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

401 K Net Unrealized Appreciation Nua Rules And Caveats

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Biden Plans To Tax Generational Wealth Transfer Through Unrealized Capital Gains At Death Brammer Yeend Cpas

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Biden To Include Minimum Tax On Billionaires In Budget Proposal The New York Times

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Wyden Details Proposed Tax On Billionaires Unrealized Gains Roll Call

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

What Are Unrealized Gains And Losses

Crypto Tax Unrealized Gains Explained Koinly

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

The Madness Of Taxing Unrealized Capital Gains Oped Eurasia Review

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies